Why Choose Us for GST Return Filing in Delhi?

- Professional Expertise: Our team of certified GST consultants has years of experience in handling GST return filing for businesses of all sizes.

- Personalized Services: We understand the unique needs of every business and provide solutions that best suit your operations.

- Timely Filing: We ensure your GST returns are filed accurately and on time to avoid penalties.

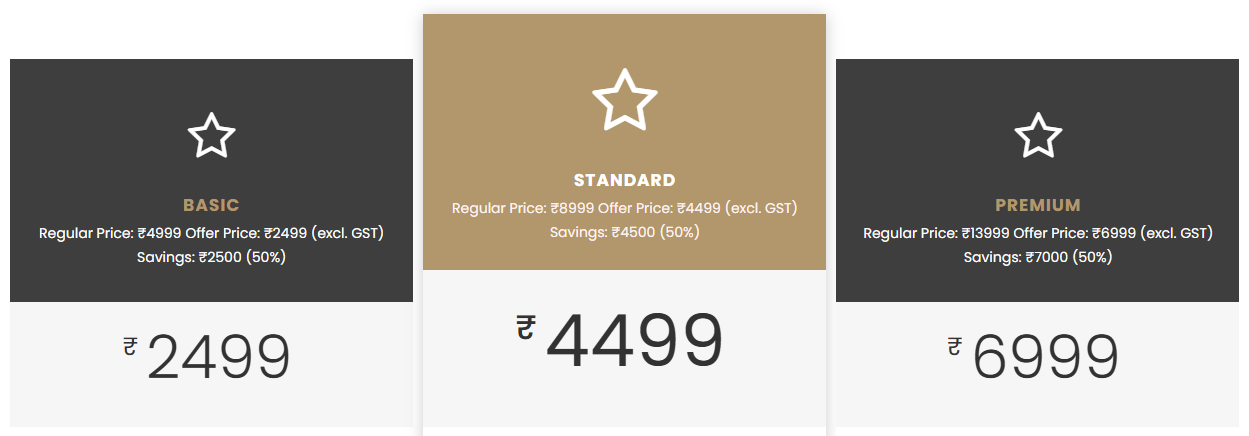

- Affordable Fees: We offer competitive pricing for our services, making GST compliance affordable for businesses of all sizes.

- End-to-End Support: From consultation to filing, we provide full support at every stage of the GST filing process.

Contact with Our GST Filing Consultants in Delhi

Our team of experienced GST filing consultants in Delhi understands the intricacies of the GST system and provides personalized solutions tailored to your business’s specific needs. We assist you in managing your tax liabilities, maximizing your input tax credits, and ensuring that all required documents and details are accurately filed. With our expertise, you can focus on growing your business while we handle the complexities of GST compliance and return filing.

By choosing us as your GST partner, you ensure peace of mind, knowing that your tax filings are in good hands. Stay compliant, avoid penalties, and optimize your tax position with the professional guidance of GST Consultants in Delhi. Let us handle the paperwork, so you can concentrate on what matters most – growing your business. Contact us today for expert consultation and hassle-free GST return filing services in Delhi.